Why Your Digital Self-Service Initiatives Are Underperforming

Most FI executives are looking to preserve profit margins as economic uncertainty continues. Costs and interest rates are up, financing is more challenging, and hiring and retaining workers are more difficult. Many hope that the investments they made in digital initiatives will drive efficiency and automation when they most need it.

However, Boston Consulting found that nearly 70% of digital transformations fall short of their objectives, often with profound consequences.

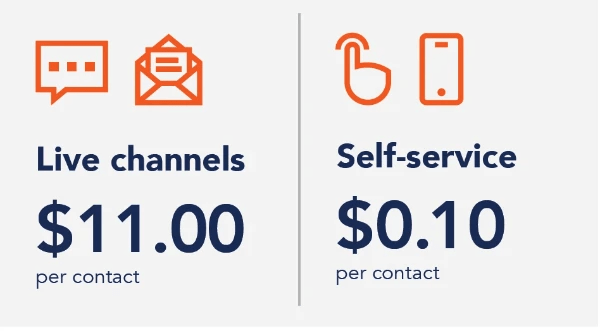

Many FIs are opening up new channels for their customers to communicate with them - on their website, chat, text, or Twitter. However, when customers can’t resolve their issue completely in a digital channel, they reach out to a live rep to solve their problem. If your customers are accessing these new digital channels, and they haven't stopped using more expensive live channels, even for one step in their journey, resolving their issue can cost 80-100x more.

This approach adds more stress and pressure to your overburdened origination or servicing teams, especially in the current labor market where top performers are scarce, expensive and in demand.

“While there will always be live service, that type of service should be treated like a precious resource.” - Gartner

Why can't you be more like Amazon?

Most people have grown accustomed to online experiences where they can resolve their request in minutes, like placing an order on Amazon. Imagine filling your shopping cart then waiting hours or days for a confirmation that you can buy those items. And if you have an issue with the purchase, how often do you call Amazon to resolve it?

Instead of making customer service reps available for every small issue, Amazon empowers customers to find their own solutions on their site whenever possible. Amazon adopted a self-service dominant approach to close new business and provide ongoing service to merchants and customers. FIs can learn from this for their front and back-office teams, especially as Amazon itself is attacking financial services from every angle.

Many FIs focused investment on digital strategies with the goal of improving the customer experience at a lower cost. Yet, those benefits haven't been realized. Why is that?

Getting self-service right can help FIs see the financial benefit of their digital investments. But when customers switch between channels, the cost goes up for each live interaction they access to resolve their issue. Focusing on containing customers in the self-service channel so they can resolve their issue can have measurable financial benefits.

Let’s look at an example of 1,000 FI customers engaging with their FI.

Gartner reports that only 13% of customers resolve their issues in the self-service channel. That’s 130 out of 1,000. The other 870 are using live channels, which means the cost is $9,570. By increasing the 13% just to 25%, the cost becomes $8,250. Scale that up to the thousands of members you serve, and the financial impact can be material.

What does it mean to be self-service dominant?

For many FIs, self-service experiences result in dead ends forcing customers to seek out a live rep. Becoming self-service dominant means making it a priority to resolve the customer’s issue in the self-service channel. A vast majority of customers are starting their journey with the digital tools offered, but only a select few are able to resolve their issue without engaging a live resource.

Let's look at an example of a well-intentioned self-service effort that can be fixed so that the customer resolves the issue within the self-service experience.

Many credit unions and auto finance companies added forms to their websites or online banking portals for customers to skip a loan payment or receive an extension. In some cases, borrowers can sign the skip-a-pay/extension agreement. The goal was to empower customers to self-serve. But this self-service effort only addresses two pieces of the resolution journey - allowing customers to apply without calling and sign the agreement.

However, customers must wait to see if they qualify, which can take hours or days resulting in customers engaging an assisted channel to check on status updates. The reason self-service resolution in minutes is not possible is that the servicing team has manual tasks to undertake:

- review the application to confirm the customer qualifies and the application is complete;

- notify the customer if they don’t qualify and generate an adverse action letter, if required;

- notify the customer if they do qualify and process the transaction in the core;

- get signatures from co-borrowers if not on the original form;

- add the skip-a-pay fee, if any, to the next month’s statement, and

- ensure the fee is debited from the customer’s account

Imagine if you could eliminate the manual steps above. Customers could self-serve and get an answer immediately - and the back office would not need to manually process the request. This is what self-service dominant strategy looks like.

But is this even possible?

Self-service resolution is within reach today.

With legacy technology, eliminating human processing is sometimes easier said than done. For example, core processing systems limit self-service options FIs can offer to their customers. Ripping and replacing systems is not always an option. As fintechs mature, more are finding ways to access data stored in legacy cores for display of data and post transactions back to the core. This roundtrip of data opens up a world of possibility so FIs can confidently deploy a self-service strategy that delivers on the lower cost promise.

Here are the 4 steps you can take today to become self-service dominant

- Identify 3 top business goals where self-service can make a material financial impact and delight your customers. Evaluate your current inbound traffic that involves customer service support at any point of the customer resolution journey. With originations down in the current marketing, that may include high volume loan servicing or collections tasks.

- Evaluate fintechs (most likely) or other partners that have out-of-the-box solutions available today. Your core and online banking providers and CX consultants may have solutions on the roadmap, but they still need to be built, tested, debugged and pushed to production. Identify solutions that deliver on the promise of self-service containment and confirm there are no dead ends in the customer resolution journey. Only choose solutions that can interact with your digital banking platform and core system providers (or other data source like a data warehouse).

- Make sure that the self-service options are easy to find in your digital banking experience or customer portal. If they can't find or access self-service, they'll resort to assisted channels to get help. The self-service options should be available in the customer's primary menu of options (e.g. online banking dashboard). If that's not possible, make sure your site search bar is prominently displayed and self-service options appear for commonly searched terms related to the issue. You don't have to get rid of your other channels. Just be sure to point those channels to the self-service option.

- Review planned “self-service” investments. If customers can’t resolve their issue in the self-service channel, consider redirecting those dollars to initiatives that do. For current and future self-service investments, track two key metrics:

- % of customers who resolve their issue in the self-service channel using Hotjar or other tool, and

- issue volume reduction on customer service reps.

About Constant

Constant, a CUNA Strategic Services alliance partner, is the only software provider that fully automates loan servicing so members can resolve issues entirely in their online banking account - and then leverages insights from those actions to make relevant product offers to the member. With Constant, credit unions can reduce operating costs, empower members to self-serve, and leverage member self-service actions to deliver tailored product offerings. Constant helps FI executives expand profit margins in any market. We help drive down OpEx, reduce labor market exposure, improve compliance, and connect better with customers. We do this by partnering with FIs to adopt a self-service dominated approach for manual loan servicing, collections and recovery efforts.